Protect Your Youngster's Future: Find out to Save for College Intelligently

Structure a Solid Financial Structure for University: Top Strategies for Smart Preparation

As the expense of college proceeds to climb, it has become progressively important for trainees and their families to develop a strong financial structure for their greater education. In this discussion, we will certainly explore the top techniques for smart economic planning for college, consisting of establishing clear goals, comprehending university costs, producing a spending plan and savings plan, discovering scholarships and grants, and taking into consideration pupil funding alternatives.

Establishing Clear Financial Goals

Setting clear monetary goals is an important action in reliable economic planning for university. As students prepare to start their greater education trip, it is essential that they have a clear understanding of their economic objectives and the steps required to accomplish them.

The initial facet of establishing clear economic goals is specifying the cost of college. This involves investigating the tuition charges, holiday accommodation costs, books, and various other various costs. By having an extensive understanding of the financial needs, students can establish reasonable and possible goals.

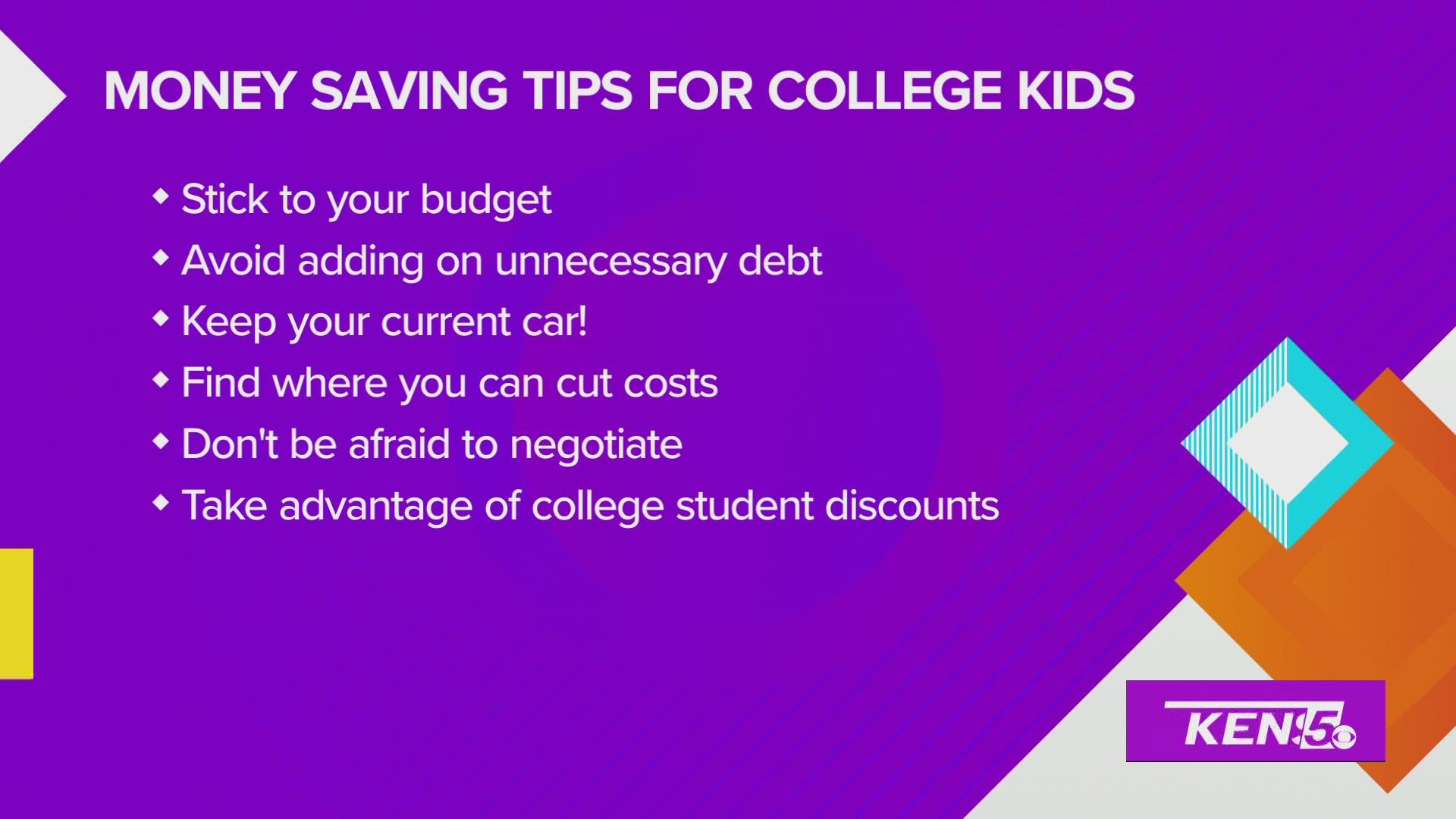

Once the expense of college has actually been identified, pupils need to develop a budget. This entails examining their revenue, including scholarships, grants, part-time tasks, and parental contributions, and afterwards alloting funds for necessary costs such as tuition, housing, and food. Producing a budget plan assists pupils prioritize their spending and ensures that they are not spending beyond your means or building up unnecessary financial debt.

Additionally, establishing clear economic goals likewise entails recognizing the demand for savings. Pupils must figure out just how much they require to save each month to cover future costs or emergency situations. By establishing a savings goal, trainees can create healthy and balanced economic habits and prepare for unforeseen circumstances.

Understanding College Expenses

Comprehending these prices is crucial for reliable financial planning. It is important for trainees and their families to completely study and comprehend these costs to create a realistic budget plan and monetary plan for university. By understanding the numerous parts of university expenses, individuals can make enlightened choices and stay clear of unneeded financial stress and anxiety.

Producing a Spending Plan and Savings Plan

Developing a thorough budget and financial savings plan is essential for effective economic planning throughout university. Start by listing all your sources of income, such as part-time tasks, scholarships, or financial aid. It needs regular monitoring and adjustment to guarantee your economic security throughout your college years.

Checking Out Scholarships and Grants

To optimize your funds for university, it is essential to check out offered scholarships and gives. Save for College. Grants and scholarships are a great way to finance your education without needing to rely greatly on loans or personal savings. These economic help are typically awarded based on a variety of elements, such as academic accomplishment, athletic efficiency, extracurricular involvement, or monetary requirement

Begin by researching scholarships and gives provided by schools you want. Several institutions have their very own scholarship programs, which can provide considerable economic assistance. Additionally, there are numerous outside scholarships readily available from organizations, foundations, and companies. Sites and on the internet data sources can help you locate scholarships that match your certifications and rate of interests.

When requesting scholarships and grants, it is important to pay attention to due dates and application requirements. Most scholarships need a finished application, an essay, letters of recommendation, and transcripts. Save for College. Make certain to follow all directions very carefully and send your application in advance of the deadline to increase your possibilities of obtaining funding

Discovering Pupil Finance Options

When thinking about exactly how to finance your college education, it is important to discover the various alternatives available for trainee loans. Pupil lendings are a convenient and usual means for trainees to cover the costs of their education and learning. Nonetheless, it is crucial to understand the various types of student finances and their terms prior to making a choice.

Another alternative is private trainee lendings, which are given by banks, cooperative credit union, and other exclusive lending institutions. These car loans often have greater rate of interest and more stringent payment terms than federal car loans. Exclusive loans may be you can try here necessary if government financings do not cover the full expense of tuition and various other expenses.

Conclusion

Finally, constructing a strong economic foundation for university calls for setting clear goals, comprehending the prices involved, creating a budget plan and savings strategy, and discovering scholarship and grant opportunities. It is crucial to think about all available alternatives, consisting of student car loans, while reducing personal pronouns in an academic writing design. By adhering to these approaches for clever planning, pupils can browse the financial aspects of his comment is here college and lead the way for a successful scholastic journey.

As the cost of university proceeds to rise, it has come to be progressively important for trainees and their family members to build a strong financial foundation for their greater education. In this conversation, we will check out the leading strategies for wise monetary planning for college, including establishing clear objectives, recognizing university costs, producing a budget plan and cost savings plan, checking out scholarships and grants, discover this info here and thinking about trainee car loan alternatives. It is vital for trainees and their households to completely research study and understand these costs to develop a realistic budget and economic strategy for college. These monetary aids are typically granted based on a variety of aspects, such as scholastic achievement, sports efficiency, extracurricular involvement, or financial need.

By adhering to these approaches for clever planning, trainees can browse the economic elements of university and pave the method for a successful scholastic journey.